Life Insurance in and around Osawatomie

Insurance that helps life's moments move on

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

- Miami County

- Linn County

- Franklin County

- Paola

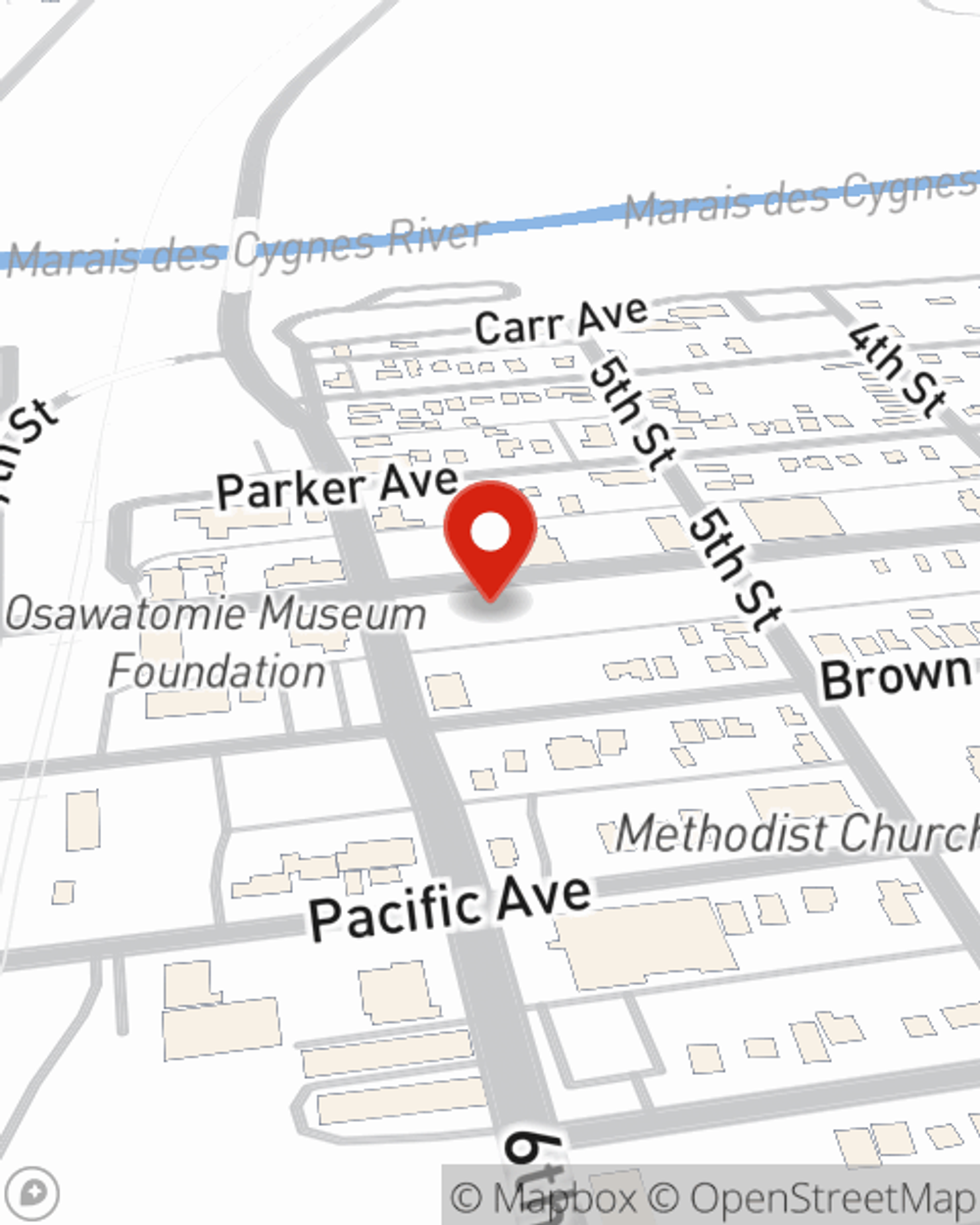

- Osawatomie

- Louisburg

- Fontana

- Lacygne

- Linn Valley

- Lane

- Greeley

- Garnett

- Rantoul

- Mound City

- Centerville

- Spring Hill

- Pleasanton

- Richmond

It's Time To Think Life Insurance

The normal cost of funerals today is around $8,300, according a recent study by the National Funeral Directors Association. Unfortunately, it may be difficult for those closest to you to pay for your burial or cremation as they mourn. That's where Life insurance with State Farm comes in. Having the right coverage can help the ones you leave behind pay for burial costs and not end up with large debts.

Insurance that helps life's moments move on

Life won't wait. Neither should you.

Agent Marsha Adams, At Your Service

You’ll get that and more with State Farm life insurance. State Farm has outstanding coverage options to keep your family members safe with a policy that’s adjusted to align with your specific needs. Luckily you won’t have to figure that out alone. With personal attention and terrific customer service, State Farm Agent Marsha Adams walks you through every step to generate a plan that secures your loved ones and everything you’ve planned for them.

Simply reach out to State Farm agent Marsha Adams's office today to check out how the State Farm brand can help cover your loved ones.

Have More Questions About Life Insurance?

Call Marsha at (913) 755-3370 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.

Marsha Adams

State Farm® Insurance AgentSimple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.